MIRAE ASSET NIFTY SMALLCAP 250

MOMENTUM QUALITY 100 ETF$ (NSE Symbol : SMALLCAP, BSE Code: 544130)

(An open-ended scheme replicating/ tracking Nifty Smallcap 250 Momentum Quality 100 Total Return Index)

| Type of Scheme | An open-ended scheme replicating/ tracking Nifty Smallcap 250 Momentum Quality 100 Total Return Index |

| Investment Objective | The investment objective of the scheme is to generate returns, before expenses, that are commensurate with the performance of the Nifty Smallcap 250 Momentum Quality 100 Total Return Index, subject to tracking error. There is no assurance or guarantee that the investment objective of the scheme would be achieved. |

Fund Manager**

|

Ms. Ekta Gala & Mr. Vishal Singh (since February 23, 2024) |

| Allotment Date | 23rd February 2024 |

| Benchmark Index | Nifty Smallcap 250 Momentum Quality 100 TRI |

| Minimum Investment Amount^ |

Market Maker: Application for subscription of Units directly with the Fund in Creation Unit Size at NAV based prices in exchange of Portfolio Deposit and Cash Component. Large Investors: Minimum amount of ₹25 crores for transacting directly with the AMC. Other investors (including Market Maker, Large Investors and Regulated Entities): Units of the Scheme can be subscribed (in lots of 1 Unit) during the trading hours on all trading days on the NSE and BSE on which the Units are listed. On exchange In multiple of 1 units Directly with AMC In multiple of 2,00,000 units |

Systematic Investment Plan (SIP) (Any Date SIP is available from 1st July, 2019) |

NA |

| Load Structure | Entry load: NA Exit load: If redeemed within 3 months from the date of allotment: 0.50%. If redeemed after 3 months from the date of allotment: NIL. |

| Plans Available Options Available |

The Scheme does not offer any Plans/Options for investment |

| Monthly Average AUM (₹ Cr.) as on June 30, 2024 | 238.2356 |

| Net AUM (₹ Cr.) | 259.11 |

| Tracking Error Value~ ~Since Inception Tracking Error is |

0.31% |

| Monthly Total Expense Ratio (Including Statutory Levies) as on June 30, 2024 | 0.38% |

| **For experience of Fund Managers Click Here | |

| ^The applicability of said threshold limit for all investors (other than Market Makers) has been extended for the below categories of investors till October 31, 2024:- 1. Schemes managed by Employee Provident Fund Organisation, India. 2. Recognized Provident Funds, Approved Gratuity Funds and Approved Superannuation Funds under Income Tax Act, 1961. |

|

| ₹ 50.8289 (Per Unit) |

| Portfolio Holdings | % Allocation |

Equity Shares |

|

Capital Markets |

|

Central Depository Services (India) Limited |

2.42% |

Multi Commodity Exchange of India Limited |

2.11% |

Nippon Life India Asset Management Limited |

1.68% |

360 One WAM Limited |

1.59% |

Indian Energy Exchange Ltd |

1.57% |

Motilal Oswal Financial Services Limited |

1.55% |

Industrial Manufacturing |

|

Cochin Shipyard Limited |

3.02% |

Titagarh Rail Systems Limited |

2.20% |

Jupiter Wagons Limited |

1.51% |

Praj Industries Limited |

0.82% |

Elecon Engineering Company Limited |

0.62% |

Auto Components |

|

Amara Raja Energy & Mobility Ltd |

3.01% |

Exide Industries Limited |

2.90% |

HBL Power Systems Limited |

0.91% |

CIE Automotive India Limited |

0.58% |

JBM Auto Limited |

0.43% |

Construction |

|

NCC Limited |

2.09% |

NBCC (India) Limited |

1.69% |

IRCON International Limited |

1.17% |

Engineers India Limited |

0.94% |

RITES Limited |

0.57% |

PNC Infratech Limited |

0.55% |

Finance |

|

Housing & Urban Development Corporation Limited |

3.04% |

Manappuram Finance Limited |

0.93% |

IIFL Finance Limited |

0.87% |

Can Fin Homes Limited |

0.60% |

CreditAccess Grameen Limited |

0.49% |

PNB Housing Finance Limited |

0.46% |

Capri Global Capital Limited |

0.35% |

Industrial Products |

|

Finolex Cables Limited |

1.39% |

Finolex Industries Limited |

1.06% |

Godawari Power And Ispat limited |

0.89% |

KSB Limited |

0.66% |

Usha Martin Limited |

0.57% |

Welspun Corp Limited |

0.54% |

Jindal Saw Limited |

0.49% |

Graphite India Limited |

0.31% |

RHI Magnesita India Limited |

0.24% |

IT - Software |

|

Birlasoft Limited |

1.06% |

Sonata Software Limited |

1.04% |

Intellect Design Arena Limited |

0.91% |

Zensar Technologies Limited |

0.79% |

Tanla Platforms Limited |

0.65% |

Mastek Limited |

0.34% |

Pharmaceuticals & Biotechnology |

|

Glenmark Pharmaceuticals Limited |

2.34% |

Natco Pharma Limited |

1.16% |

AstraZeneca Pharma India Limited |

0.46% |

Eris Lifesciences Limited |

0.40% |

Caplin Point Laboratories Limited |

0.31% |

Non - Ferrous Metals |

|

National Aluminium Company Limited |

2.74% |

Hindustan Copper Limited |

1.85% |

Consumer Durables |

|

Crompton Greaves Consumer Electricals Limited |

2.81% |

Amber Enterprises India Limited |

0.62% |

VIP Industries Limited |

0.23% |

Electrical Equipment |

|

Apar Industries Limited |

2.45% |

Triveni Turbine Limited |

0.78% |

Chemicals & Petrochemicals |

|

Himadri Speciality Chemical Limited |

1.04% |

Gujarat Narmada Valley Fertilizers and Chemicals Limited |

0.52% |

Fine Organic Industries Limited |

0.46% |

PCBL Limited |

0.36% |

Balaji Amines Limited |

0.24% |

Banks |

|

Karur Vysya Bank Limited |

1.85% |

Indian Overseas Bank |

0.60% |

Gas |

|

Aegis Logistics Limited |

1.43% |

Mahanagar Gas Limited |

0.92% |

Petroleum Products |

|

Castrol India Limited |

1.45% |

Chennai Petroleum Corporation Limited |

0.76% |

Agricultural, Commercial & Construction Vehicles |

|

BEML Limited |

1.18% |

Action Construction Equipment Limited |

0.91% |

Paper, Forest & Jute Products |

|

Century Textiles & Industries Limited |

1.56% |

JK Paper Limited |

0.37% |

Commercial Services & Supplies |

|

Redington Limited |

1.10% |

Firstsource Solutions Limited |

0.52% |

Quess Corp Limited |

0.30% |

Leisure Services |

|

EIH Limited |

1.33% |

BLS International Services Limited |

0.46% |

Realty |

|

Sobha Limited |

1.13% |

Sunteck Realty Limited |

0.21% |

Transport Services |

|

The Great Eastern Shipping Company Limited |

1.26% |

Healthcare Services |

|

Narayana Hrudayalaya Limited |

0.76% |

Metropolis Healthcare Limited |

0.45% |

IT - Services |

|

Cyient Limited |

1.19% |

Fertilizers & Agrochemicals |

|

Chambal Fertilizers & Chemicals Limited |

0.67% |

Gujarat State Fertilizers & Chemicals Limited |

0.49% |

Telecom - Services |

|

HFCL Limited |

1.04% |

Aerospace & Defense |

|

Garden Reach Shipbuilders & Engineers Limited |

0.88% |

Cigarettes & Tobacco Products |

|

Godfrey Phillips India Limited |

0.87% |

Automobiles |

|

Olectra Greentech Limited |

0.83% |

Power |

|

NLC India Limited |

0.67% |

Retailing |

|

Indiamart Intermesh Limited |

0.66% |

Transport Infrastructure |

|

Gujarat Pipavav Port Limited |

0.65% |

Agricultural Food & other Products |

|

Triveni Engineering & Industries Limited |

0.47% |

Gujarat Ambuja Exports Limited |

0.15% |

Cement & Cement Products |

|

JK Lakshmi Cement Limited |

0.35% |

Birla Corporation Limited |

0.25% |

Household Products |

|

Jyothy Labs Limited |

0.54% |

Entertainment |

|

Saregama India Limited |

0.45% |

Minerals & Mining |

|

Gujarat Mineral Development Corporation Limited |

0.33% |

Textiles & Apparels |

|

Welspun Living Limited |

0.25% |

Food Products |

|

Avanti Feeds Limited |

0.24% |

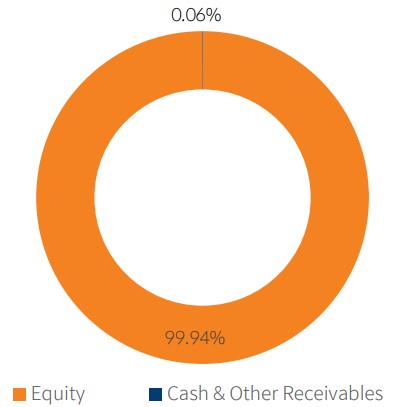

Equity Holding Total |

99.94% |

Cash & Other Receivables Total |

0.06% |

Total |

100.00% |

Live iNav is updated on Mirae Asset Mutual Fund website

NSE Symbol :SMALLCAP

BSE Code:544130

Bloomberg Code:MAS250MQ IN Equity

Reuters Code: MIRA.NS

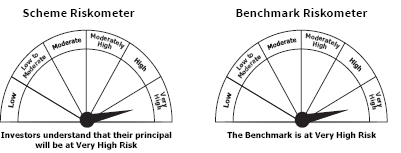

This product is suitable for investors who are seeking*

•Returns that commensurate with performance of Nifty Smallcap 250 Momentum Quality 100 Total Return Index, subject to tracking error over long term

• Investments in equity securities covered by Nifty Smallcap 250 Momentum Quality 100 Total Return Index

*Investors should consult their financial advisers if they are not clear about the suitability of the product.

$Pursuant to clause 13.2.2 of SEBI master circular dated June 27, 2024, the scheme is in existence for less than 6 months, hence performance shall not b provided